Behind the Line: Nintendo’s Investors Call, Mobile, and Switch Library

It’s that time again. The 77th Annual General Meeting of Shareholders. There’s a lot of plain stuff that doesn’t concern most people, even in the industry (e.g. Will shareholders get a special treat when the universal studios park opens? C’mon, man!) But there are some interesting nuggets of information to highlight, including some financials reported for Super Mario Run.

Title count/3rd party support

Included in a long question was a comparison of the Wii U library to legendary systems:

[…] More than 1,000 titles were released for Family Computer System (known as Nintendo Entertainment System outside Japan) during its ten-year lifespan and more than 1,300 titles were released for Super Famicom (known as Super Nintendo Entertainment System outside Japan) during its ten-year lifespan. Compared to that, there were only between 100 and 200 titles released for Wii U during its five-year lifespan. […]

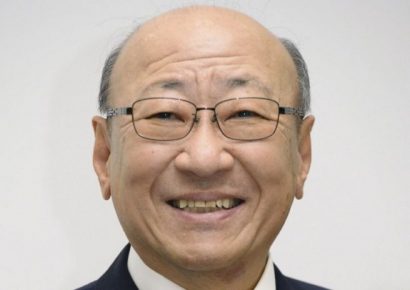

Nintendo President Tatsumi Kimishima explained with perfect business sense

[…] Software publishers determine whether to develop for a video game system based on its momentum. With this in mind, we are planning to sell 10 million units of Nintendo Switch hardware during this fiscal year. If we can sell 10 million units in one year, then software publishers will feel more at ease about investing in development for Nintendo Switch. […]

This is dead on. The Wii U didn’t have enough market share, it wasn’t worth supporting by third parties, so it had a small library. This isn’t a lever that Nintendo can affect directly other than to show the platform is viable to support. Higher market penetration is crucial to that end.

Nintendo President: Tatsumi Kimishima. Not as warm looking as Satoru Iwata, but at least he’s learned how to smile!

Testing and Support

In the same question this interesting nugget appeared

[…] I read in an article that Nintendo devotes approximately 300 people for debugging in the final stages of software development to raise game quality and ensure that the intentions of the developers were conveyed smoothly […]

I tried to find the article referenced here, but could only find posts that reference back to this meeting. It’s possible that the article isn’t available in English, or I simply haven’t found it. In any case, Kimishima also addressed this:

[…] I believe that the article you read conveyed that our framework is more than capable enough to handle debugging (the process of checking to make sure the software behaves as intended by the developers). To help software publishers feel at ease about developing with Nintendo, we need to steadily release our own titles and show them that momentum. […]

In the articles talking about this, I see that people are repeating this based on the representation in the question, rather than what Kimishima said. The answer didn’t exactly define the role of these testers. Are they simply running standard test verification? Sony and Microsoft do this as well, and that isn’t news. In fact, I would suggest that 300 testers for that would be running pretty lean. Are these testers a separate pool that work during game development? The only thing this really says is that Nintendo has testers that work on games, and that would be a safe assumption anyway.

Are the Switch and the DS stepping on each others toes?

One question centered on the concept of the Switch getting a Pokemon game, a franchise usually seen as a handheld game. The Switch is said to not compete in the handheld market. Nintendo didn’t give much of an answer to explain this apparent contradiction/conflict. They seemed to mostly give corporate double speak about the nature of the Switch.

Super Mario Run business performance

Responding to a question about mobile monetization strategies, Kimishima gave some numbers for Super Mario Run:

[…] Super Mario Run has seen over 150 million downloads and access from over 200 countries. Less than 10 percent of these consumers have actually purchased the full game […]

And

[…] The number of downloads of Fire Emblem Heroes is less than a tenth of the number for Super Mario Run, but the total figure that consumers have spent on this title is more than on Super Mario Run. […]

Some quick math –

150 mil downloads * 10% conversion rate = 15 Million paying players * $10 per conversion = $150 million gross revenue * ~ 70% publisher share ~$100 million or greater in revenue in 7 months. This is considered UNDER performing for Nintendo. Gamasutra’s headline described the performance as “lackluster”. Keep in mind, these are users who tried the game and liked it enough to pay. This isn’t a game where you pay up front and are possibly disappointed, its execution HAD to sell it! Nintendo may have expected more from the Mario brand, but compared to the vast bulk of mobile? Well… take it away Zandig:

If they can fine tune their methodology and business on mobile, there is a BIG upside to it for them. I don’t understand why these numbers aren’t getting covered more. This indicates a significant potential bow wave for Nintendo’s mobile presence.

Other odds and ends for Nintendo

The current top selling charts in Japan, 8 of the top 10 console games are on Nintendo consoles. As Gamasutra points out, this doesn’t include Mobile titles, whose numbers are harder to pin down anyway.

Gamasutra: Most of Japan’s top selling 2017 games are on Nintendo Platforms

This is another big bow wave indicator for Nintendo right now. It is showing strong platform support, which drives unit sales for the Switch, and the 3DS, which in turn attracts developers. In addition to this, it seems that they are consciously learning some lessons from the Wii U debacle and intentionally releasing very different types of games at launch to try to demonstrate different capabilities of the Switch, and show the range of customers it can appeal to.

Gamasutra: How Nintendo is using first party Switch games to inspire third party devs

First round, Breath of the Wild, 1-2 Switch, and Snipperclips. These games are all certainly different from each other in terms of core demographic, and utilization of the hardware.

Second round, Mario Kart, ARMS, Splatoon, and Mario Odyssey. Added together, this early library feels broad, and far more comprehensive than the Wii U had. It shows off good IP, and a range of game types to show off the hardware potential. For comparison, here are the titles for the Wii U’s first year that Nintendo had a hand in developing:

- New Super Mario Brothers U

- Nintendo Land

- Sing Party

- Lego City Undercover

- New Super Luigi U

- Game & Wario

- Pikmin 3

- The Wonderful 101

- WindWaker HD

- Wii Party U

- Wii Fit U

- Wii Sports Club

- Mario & Sonic at the Sochi 2014 Olympic Winter Games

I don’t mean to speak ill of these titles, but I feel the 7 Switch titles cover more ground in a more compelling way than these 13 titles.

All of this fits into Kimishima’s statement regarding the library size. I think they’re handling the Switch in an intelligent way, and I think barring something that disrupts the industry to the core that the Switch will be a strong platform for a while. Not saying it’ll be as successful as the Wii, because you never bet on something like that, but it’ll do just fine.

Kynetyk is a veteran of the games industry. Behind the Line is to help improve understanding of what goes on in the game development process and the business behind it. From “What’s taking this game so long to release”, to “why are there bugs”, to “Why is this free to play” or anything else, if there is a topic that you would like to see covered, please write in to kynetyk@enthusiacs.com or follow @kynetykknows

Leave a Reply